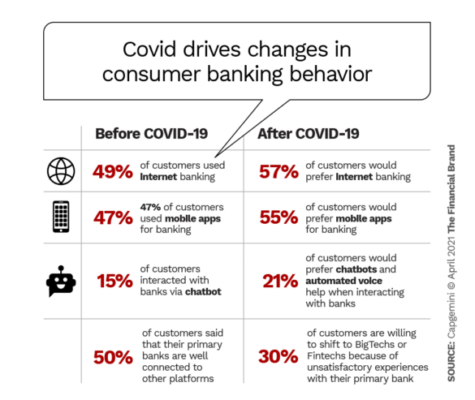

The pandemic has changed people’s perception of what’s possible and what’s feasible. In practically every industry, including banking and financial institutions, the constantly changing market, cutting-edge competition, and rising customer expectations have become a general thumb rule to adapt to.

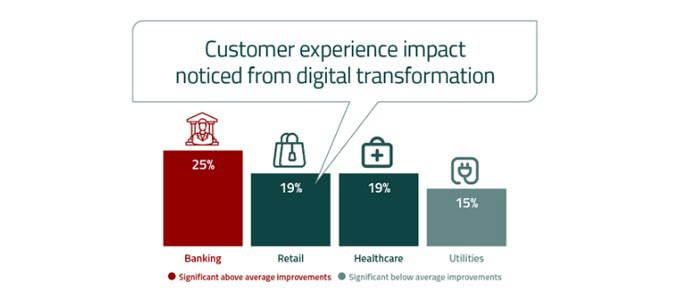

In banking, customer experience (CX) is an integral part of any strategic approach to meeting customer demands. Banks and financial institutions must undergo digital transformation to provide a uniform banking experience, whether online or in person.

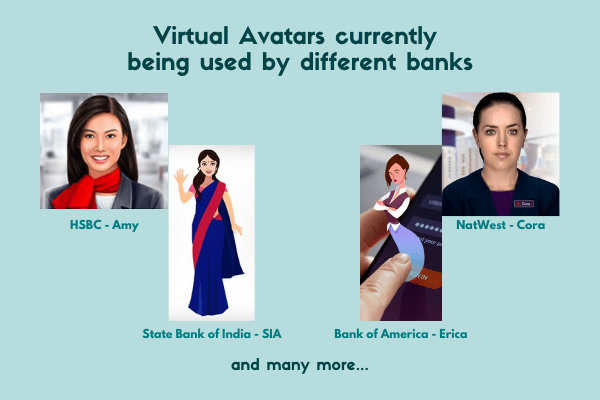

New technical capabilities are giving digital banking a facelift, from selfie authentication to computer-generated avatars. These Virtual Avatars act like actual people which analyze and respond to human emotions appropriately.

The pandemic has changed people’s perception of what’s possible and what’s feasible. In practically every industry, including banking and financial institutions, the constantly changing market, cutting-edge competition, and rising customer expectations have become a general thumb rule to adapt to.

In banking, customer experience (CX) is an integral part of any strategic approach to meeting customer demands. Banks and financial institutions must undergo digital transformation to provide a uniform banking experience, whether online or in person.

New technical capabilities are giving digital banking a facelift, from selfie authentication to computer-generated avatars. These Virtual Avatars act like actual people which analyze and respond to human emotions appropriately.

Though these innovations are disrupting the banking experience, some of the avatars continue to miss true human factors in their digital experiences.

Empathetic AI technology was developed specifically for this purpose, guiding digital banking customers through platforms and services while delivering 24/7 hyper-personalized help and humanized engagement.

Virtual Avatar is more engaging than a telephonic conversation. The technology, which can be used in AR, VR, Bank Kiosks, Mobile Apps, and the Web, is as effective as a face-to-face meeting while removing the need for travel.

Human-like candor and empathy can help computers and mortals build a stronger bond of trust. Customers’ voice patterns can now be analyzed by Virtual Avatar’s AI, allowing banks to determine if customers are happy or upset.

How Virtual Avatars transforming Banking –

Easy, remote access 24×7: Customers can now avail banking services from their everyday devices, at any time of the day, without leaving their homes. Virtual Avatar can serve many customers at once and also provides a variety of avatar options.

Personal meetings: With Virtual Avatar, you can have digital one-on-one meetings with multiple customers at the same time and provide tailored advice to individuals, walk them through new offers and products, and onboard them for new services.

Digital presentations: A Virtual Branch with a Virtual Avatar can be tailored to your specific needs, including interactive screens and presentation rooms. Customers can discover more about your company, products, and services anywhere and anytime. Run promotional videos for new services or products to attract the right customers, as well as continuing activities to keep customers engaged and educated.

Virtual guides: Online customer journey will be accompanied by a virtual banking professional throughout the process. You may provide a personalized experience for your customers by using various communication channels, to advise, showcase new products, and assist them in signing up for your bank’s services.

Document verification: The customer onboarding process has never been this simple. Through Virtual Avatars Assistance, Customers can sign papers virtually safely, and securely using a verification PIN and obtain an email copy of the document. This functionality not only simplifies the procedure for your customers but also reduces paperwork for your bank personnel and centralizes the verification and storage of all e-documents.

User data analytics: Get accurate analytics and insights on customer data as each interaction can be recorded, analyzed, and compiled in real-time to provide actionable insights. Customer actions are meticulously tracked and automatically evaluated to provide you with detailed information on customer behavior, preferences, and product information. The platform allows you to get detailed reports without the need for a human to supervise data collection.

Cost-effectiveness: Banks can save money not only on real estate but also on human resources by moving away from physical branches. Furthermore, virtual avatars automate a variety of jobs that traditionally require a lot of manual labor, such as documentation, analytics, and so on.

Quality Leads: Through Virtual Avatars, you can improve lead quality and revenue. As these virtual avatars do the initial conversation, they notify bank representatives of those customers’ individual needs, of products or services. These customers are actually interested and are guided to the next level on the sales funnel, thus increasing the conversion rate and decreasing the time to convert these leads.

A hyper-personalized and humanized experience that exceeds expectations and sets new industry standards helps customers feel understood, fosters intimacy, trust, and loyalty, and cements a definitive brand-customer relationship.

The result is not only quick and accurate, but also highly human-like: the engagement gives customers the impression that they are talking to a real person, but with a computer instead of brains thus improving the customer experience. The future of banking is virtual, and Virtual Avatar is modernizing the financial sector while also revolutionizing customer experience (CX) by providing seamless experiences and smoother transactions.